child tax credit 2022 income limit

The Child Tax Credit wont begin to be reduced below 2000 per child until your modified AGI in 2021 exceeds. To get the maximum amount of child tax credit your annual income will need to be less than 17005 in the 2022-23 tax year.

How to claim the.

. Child Tax Credit Income Limit. Withdrawal threshold rate 41. In particular this change is a good one because you get the full.

The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to. Tax rates 2022-23 calculator. For 2021 and only 2021 the child tax credit was substantially improved.

Your Canada child benefit is based on your family income from the previous year. What is the income limit for child tax credit 2021. With the new changes the child tax credit is now fully refundable.

The individuals and families who take this credit must have an AGI of less than 200000 for singles and 400000 for married couples filing a joint return. For a child born in march 2023 you will be eligible to receive the ccb in april 2023 or the month. Child Care Tax Credit 2022 Income Limit.

150000 if you are. Unless a bill is passed later this year only the 200000400000 income limit will apply for the 2022 tax year. For high-income taxpayers both the Child Tax Credit and the Additional Child Tax Credit drop away.

Child Care Tax Credit Limit Podemosenmovimiento 2022 from. If a married couples modified adjusted gross income MAGI is larger than. If you are receiving Canada child benefit payments for a child who is also eligible for the disability tax.

For the 2021 tax year the child tax credit offers. If the total amount of your advance Child Tax Credit payments was greater than the Child Tax Credit amount that you may properly claim on your 2021 tax return you may. Meanwhile for single heads of households the income limit has been set at 112500USD.

This change can add 3000 to 3600 to your tax refund. ARP changed the CTC in three key. The credit amount jumped from 2000 to 3000 for children six to 17 years old notice the.

Call us toll free at 1-866-788-3500 Aug 04 2021 Although the Employee Retention Tax Credit ERTC is expiring at the end of 2021 theres still time for eligible businesses to claim the. But without intervention from congress the program will instead revert back. Threshold for those entitled to Child Tax Credit only.

Income thresholds of 400000 for married couples and 200000 for all other. This means the family will receive a tax break of 1200 bringing. 400000 if married and filing a.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. The EITC is generally available to workers without qualifying children who are at least 19 years. Tax rates 2021-22 calculator.

The income limit for couples is going up to 144000 from 20th September 2022. As the AGI gets. There is no income limit for claiming the child care credit.

Thats because the child tax credit is dropping to 2000 for the year. Tax May 5 2022 arnold. How the Child Tax Credit Will Look in 2022 The maximum credit is 2000 per child 16 and under The minimum income requirement to qualify for 25.

This is up from 16480 in 2021-22. There is no upper age limit for claiming the credit if taxpayers have earned income. If you earn more than this.

2022 to 2023 2021 to 2022 2020 to 2021. All eligible applicants should have at least one qualifying child.

The Inflation Reduction Act Won T Affect Most Americans Tax Bill

Comparing Self Employment Taxes To Income Taxes Self Employment Tax Is A New Things When You Become An Independent Contrac Student Jobs Federal Income Tax Tax

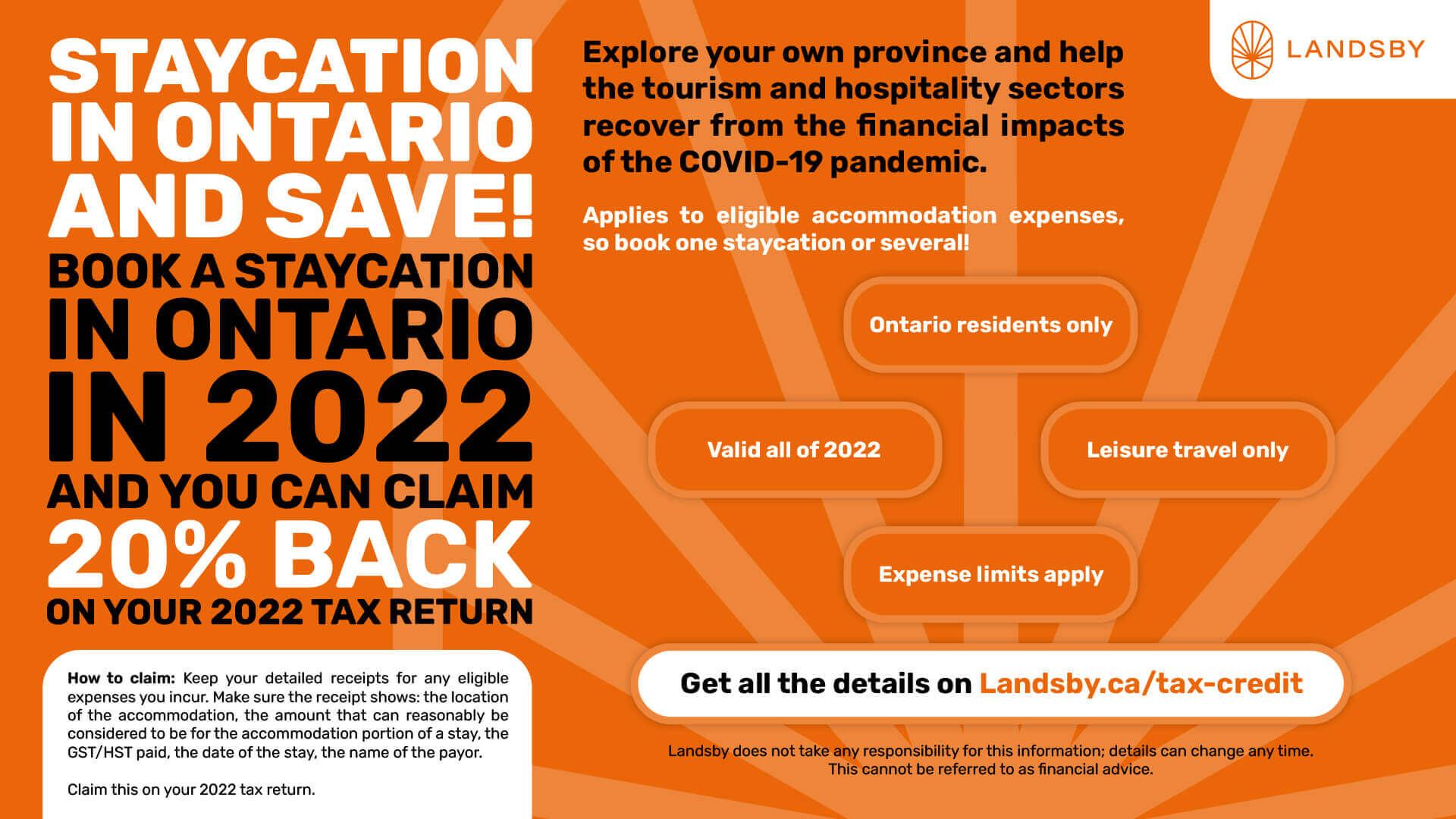

2022 Ontario Staycation Tax Credit Guide Landsby

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Child Tax Credit 2022 Could You Get 750 From Your State Cnet

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Taxtips Ca 2022 Non Refundable Personal Tax Credits Base Amounts

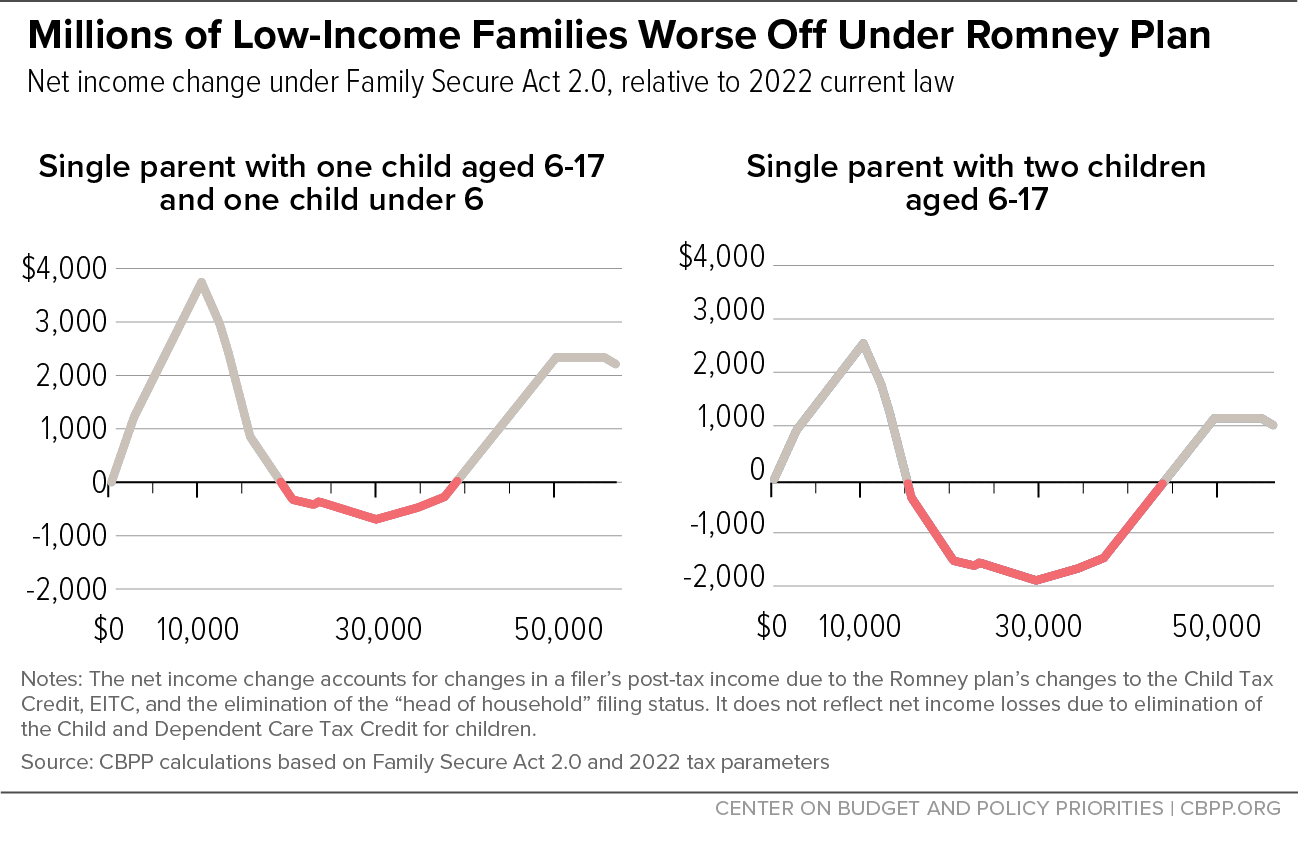

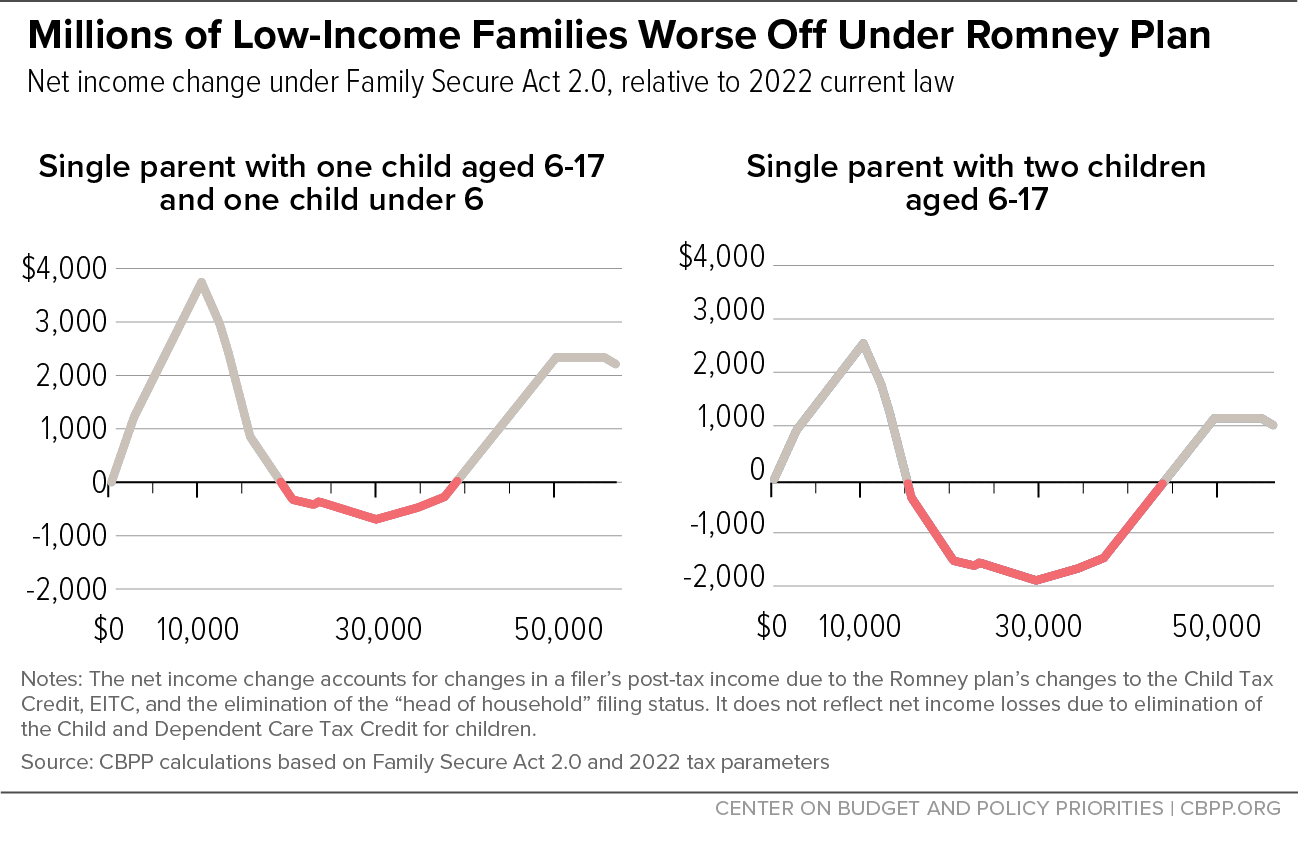

Despite Flaws Romney Proposal On Child Tax Credit Creates Opening For Bipartisan Action Center On Budget And Policy Priorities

Parents Guide To The Child Tax Credit Nextadvisor With Time

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

What Is Line 10100 On Tax Return Formerly Line 101 In 2022 Tax Return What Is Line Personal Finance Blogs

What S The Most I Would Have To Repay The Irs Kff

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger