ct estate tax return due date

For 2020 that threshold is 51 million. Failure to pay any tax due July 1 2022 on or before August 1 2022 will cause the tax to become delinquent and subject to interest from the due date at the rate of 1 ½ per full or partial month.

Connecticut Estate Tax Everything You Need To Know Smartasset

City town or post office State ZIP code Date of death Legal residence domicile county and state Connecticut Probate Court.

:max_bytes(150000):strip_icc()/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

. Offer valid for returns filed 512020 - 5312020. MTA Surcharge Return Tax Law Article 9-A Section 209-B. The average return wont dramatically increase your audit chances especially if you earn Form W-2 wages and dont have a complicated tax situation.

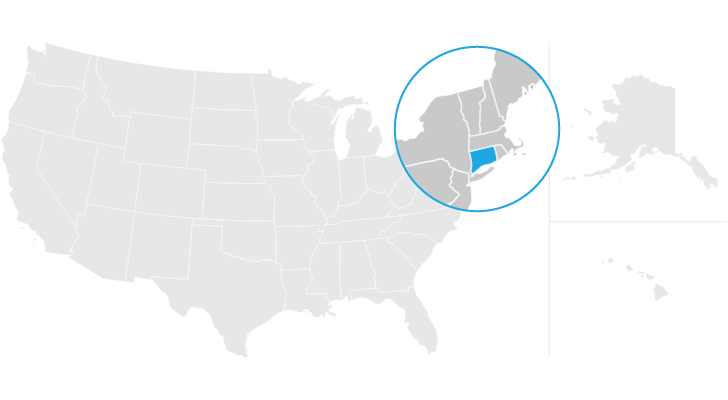

Woodbridge taxpayers are reminded that Real Estate Motor Vehicle and Personal Property taxes are due July 1 2022 and will become delinquent on August 2 2022. Enter the payment amount on line A above. Connecticuts Gift and Estate Tax Estate Tax Basis Connecticuts estate tax applies to both resident and nonresident estates valued at more than the taxable threshold.

If taxes are not paid or postmarked on or before August 1 2022 such tax will be considered delinquent and subject. The tax applies only to the value of the estate above the threshold. Email address of individual preparing this return Preparers NYTPRIN or Excl.

This calculator is for 2022 Tax Returns due in 2023. For delinquent payments interest will be charged on the unpaid installment balance at the rate of 15 per month from the due date. Upgrade to two years for 90.

The first semi-annual installment of taxes on the Grand List of October 1 2021 are due and payable on July 1 2022. A resident estate is an estate of a decedent who was domiciled in. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes.

Valid for an original 2019 personal income tax return for our Tax Pro Go service only. Must provide a copy of a current police firefighter EMT or healthcare worker ID to qualify. Physically receive the return by the due date.

In re Priest 712 F2d 1326 9th Cir. Required payment date Date Return Submitted. Checked penalties will be calculated.

For estimated tax Form CT-2221 Election to Use Different. Start with a free eFile account and file federal and state taxes online by April 18 2022 - if you miss this deadline you have until October 17 2022. Trial calculations for tax owed per return over 750 and under 20000.

Estate Transfer Tax Return Credit Line Mortgage Certificate. The actual IRS tax return mailing address depends on the state or territory that you live or. 0620 Page 3 of 5 1.

However according to Westport Tax Collector Christine Alison members of the Westport community typically pay their taxes on time and in full. Connecticut Estate Tax Return for Nontaxable Estates General Information. Department of the Treasury Internal Revenue Service Kansas City.

Form CT-706 NT Connecticut Estate Tax Return for Nontaxable Estates. The collection rate. 12 Balance due add lines 8c through 11 and enter here.

When the return was filed. Code Date Page 4 of 4 CT-3-M 2021 Composition of prepayments claimed on line 7. Notice is hereby given to the taxpayers of the City of Shelton the 1st installment of Real Estate Personal Property and Motor Vehicle taxes and Sewer Use fees on the October 1 2021 Grand List are due and payable on the 1 st day of July 2022.

WESTPORT More than 824000 is owed in property taxes from the towns top 10 delinquent taxpayers according to town documents. As a result of the 1997 Taxpayer Bill of Rights taxpayers can. The IRS will evaluate any back tax return you file in basically the same way it evaluates all returns.

A state-created lien arises when the state takes administrative steps to fix the taxpayers liability - mere. In some cases though the IRS could select a back tax return for audit. Will sign the statement on the PC255 instructing the estate to file Form CT706709 with the Commissioner of Revenue Services.

Any person as owner in whole or in part of or fiduciary having control of or interest in any real estate may file with the tax collector at any time within ninety days from the date when the first installment of a tax or the whole tax in case installments are not authorized has become due and within thirty days from the date when the second or any. No cash value and void if transferred or where prohibited. If the due date falls on a Saturday Sunday or legal holiday the return will be.

725 F2d 477 1984 holding a state law ineffective which stated that a tax lien arose when the tax return was due and payable or on the date the return was required to be filed. Section 4 Total Gross Estate as It Would Be Valued for Connecticut Estate Tax Purposes Form CT-706 NT Rev. The minimum interest charge is 2.

Before the due date of the return payment or other document.

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

:max_bytes(150000):strip_icc()/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

Which Form Does An Estate Executor Need To File H R Block

The Ird Deduction Inherited Ira Beneficiaries Often Miss

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

A Guide To Estate Taxes Mass Gov

Should You Elect The Alternate Valuation Date For Estate Tax

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Connecticut Estate Tax Everything You Need To Know Smartasset

Paper Organization Bundle File System Bundle Paper Etsy Filing System Life Binder Paper Organization

Basic Tax Reporting For Decedents And Estates The Cpa Journal

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Filing Taxes For Deceased With No Estate H R Block

When To File Form 1041 H R Block

Executor And Beneficiary Liability For Unpaid Income Gift And Estate Taxes Of A Decedent The Cpa Journal

The Basics Of Fiduciary Income Taxation The American College Of Trust And Estate Counsel